Just a brief post to share the notice Chase Banks sent their loyal checking customers regarding fees for their checking accounts. Chase has decided that if you don't make a SINGLE direct deposit of $500 every month, they will charge you $12. Note that it is a SINGLE deposit of $500, weekly or bi-weekly deposits of $499 don't count. So they've effectivly killed their free checking accounts.

Just a brief post to share the notice Chase Banks sent their loyal checking customers regarding fees for their checking accounts. Chase has decided that if you don't make a SINGLE direct deposit of $500 every month, they will charge you $12. Note that it is a SINGLE deposit of $500, weekly or bi-weekly deposits of $499 don't count. So they've effectivly killed their free checking accounts.Rather than type in all the BS on their notice, here's some scans that explain exactly HOW they plan to stick it to you, and the limited ways you have to avoid the fees.

First, the letter:

... and the fine print / footnotes:

And, hidden away in the middle of a 21 page promo brochure telling how wonderful Chase is:

Although I could meet direct deposit requirement NOW, here's the problem I have with the $12.00 fee: What if I sick and can't work? What happens if I get paid weekly, or bi-weekly, $499.99 or less? Do you really think that in this economy, people can maintain a $1500 in a checking account? And if I had $5,000 "just lying around", I would be crazy to leave it in Chase's crappy CD's (.25% to 1%) or savings accounts (0.1%, minus a $4 a month fee if balance falls under $300)???

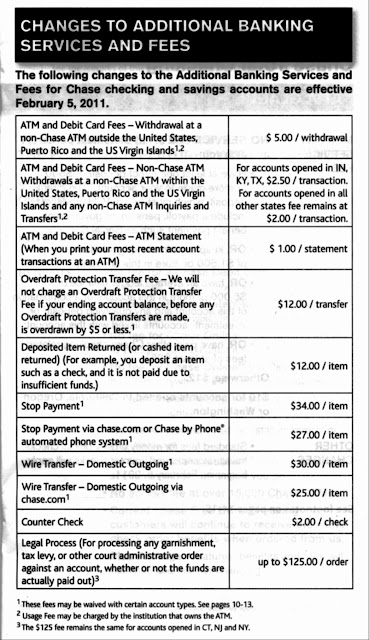

As for the other fees:

- A $5.00 for a transaction outside the USA in addition to a 3% foreign transaction fee, just outrageous.

- A$2.00 / $2.50 fee for using another bank's ATM? In addition to the OTHER bank's charges?

No Thanks. - A $1.00 fee to print a statement on your own ATMs? HUH? Really, the paper costs that much?

- $12.00 to access my own money from savings for an overdraft, WTF?

- ...And as for the rest of the fees listed, I can only describe them as "abusive" and "greedy".

Dear Chase,

We were customers of WAMU and Chase BEFORE your merger. We've maintained checking and savings accounts and credit cards with you and/or WAMU over the last 10 years. While you were busy screwing every other customer, we remained relatively unscrewed. Sure, our rates went up on our WAMU card after the merger, but it wasn't as bad as what you did to your other loyal customers. But this is too much. No more. You're not the only bank or credit union in this town, and we deserve better. We're moving our accounts to other banks and credit unions that will treat us with a lot more respect before February 8, 2011.

Bye-Bye, Chase.

No comments:

Post a Comment